Diversity Helps Weather the Storm

February 4, 2019 - Utilizing an all-weather portfolio means you don’t have to wait for the storm to pass to see a rainbow. Instead, you can prepare for the storms before they arrive, ensuring your endowment portfolio’s viability for years to come.

HighGround Advisors believes in structuring investment portfolios that can withstand periodic recessions and volatility. The HighGround Endowment Fund, or HGEF for short, is our best example of an all-weather portfolio. HGEF’s asset allocation strategy provides the diversification to hold up over longer periods of time and is more likely to meet its long-term financial objective.

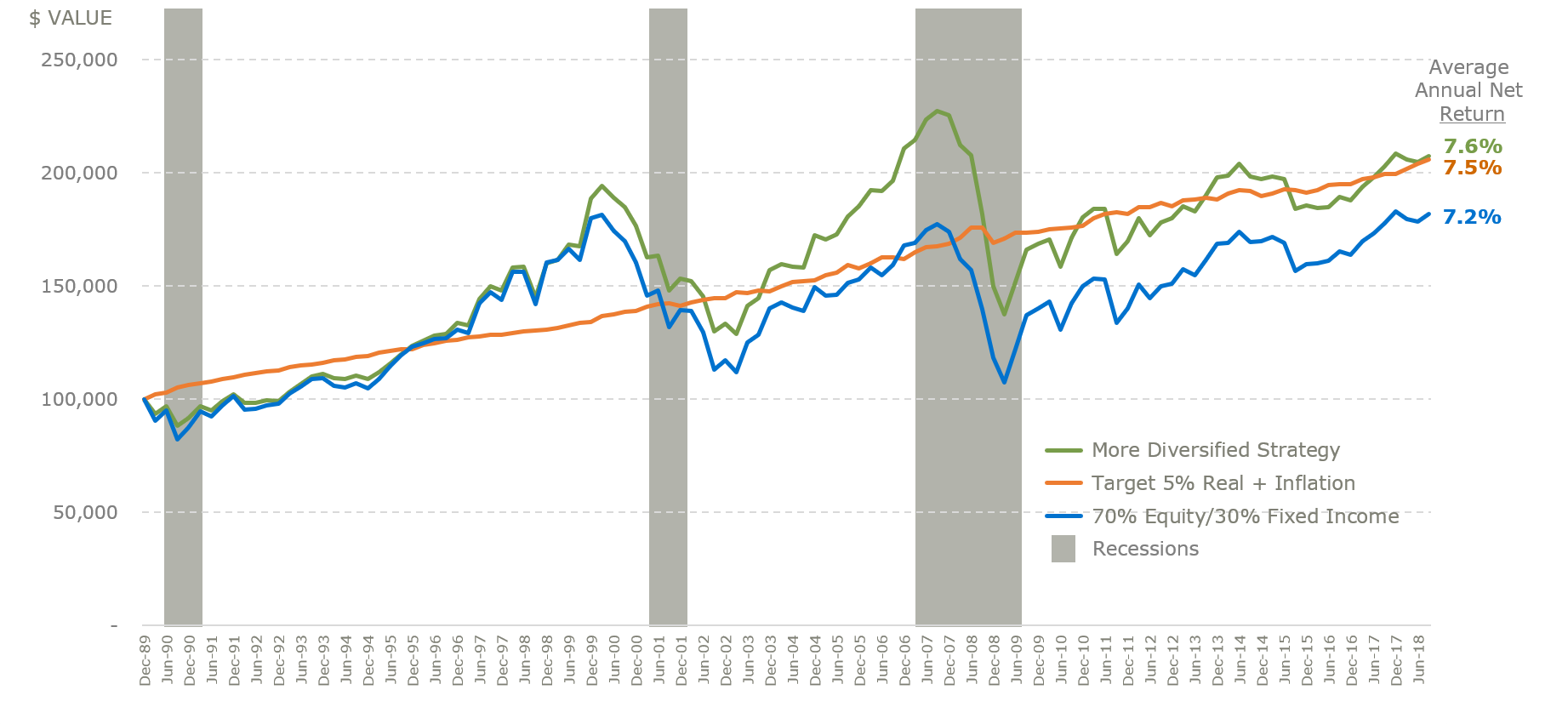

In his recent webinar presentation, To the Point, HighGround’s Senior Vice President and Chief Investment Officer, Joe Wright, compared the performance of HGEF's current strategy over the last 29-year period to a less diverse portfolio.

“We started with a $100,000 investment on January 1, 1990 and tracked its value over time using the actual quarterly performance of each portfolio,” Joe said.

For this comparison, Joe assumed an annual distribution of five percent was paid out of each portfolio, which is the distribution goal of the HGEF, plus inflation and expenses. The less diversified portfolio was comprised of a 70 percent stock and 30 percent bond passive index strategy. An expense ratio of 1.20 percent was used for the more diversified portfolio and 0.25 percent for the passive portfolio.

The time frame chosen to compare these two funds included three recessionary periods in the United States:

- Eight-month period from July 1990 through March 1991

- Eight-month period from March 2001 through November 2001

- Eighteenth-month period from December 2007 through June 2009

“There is very little difference between the values of the two portfolios during the 1990s,” Joe said. “But, when volatility spiked during the 2000 tech bust, HGEF’s more diversified policy begins to realize significantly more value than the less diversified passive strategy.”

As HGEF's strategy moved through the 2000s, its market value continued to build compared to the market value of the passive strategy.

“And, HGEF's strategy maintained its advantage in the aftermath of 2008’s financial crisis,” Joe said. “And it continues to hold its advantage through 2018, creating substantially more wealth than the passive strategy.”

For the 29-year-period which was tracked, HGEF’s strategy annualized performance was 7.6 percent, compared to 7.2 percent from the less diversified passive strategy. More importantly, HGEF's strategy was successful in meeting its long-term financial objectives. The portfolio grew, after inflation terms by 0.10 percent per year on average. The less diversified passive strategy was not successful in meeting its objective and shrunk by 0.3 percent in real after inflation terms.

“This is important because it means a university, for example, can provide more scholarships for their students or a children’s home could expand their services to accommodate additional children,” Joe said. “The bottom line is our research and testing strongly supports our view that our more diversified strategy is superior to less diversified traditional strategies in achieving the long-term objectives of endowment funds.”