Hidden in Plain Sight: Private Equity, Part 1

June 28, 2022 - The term “private equity” has become an integral part of almost every conversation about investing, owing to private equity’s prominence in the business media as a capital provider, deal maker and generator of consistently high returns to investors. Private equity investment activity and fund ownership are ubiquitous and hidden in plain sight.

But what exactly IS private equity? In this three-part series, we’ll cover the types of private equity, its key characteristics, and HighGround’s approach to these investments.

PRIVATE EQUITY DEFINED

Private equity (“PE”) refers to investments in privately held companies that are not listed or tradeable on an open market.

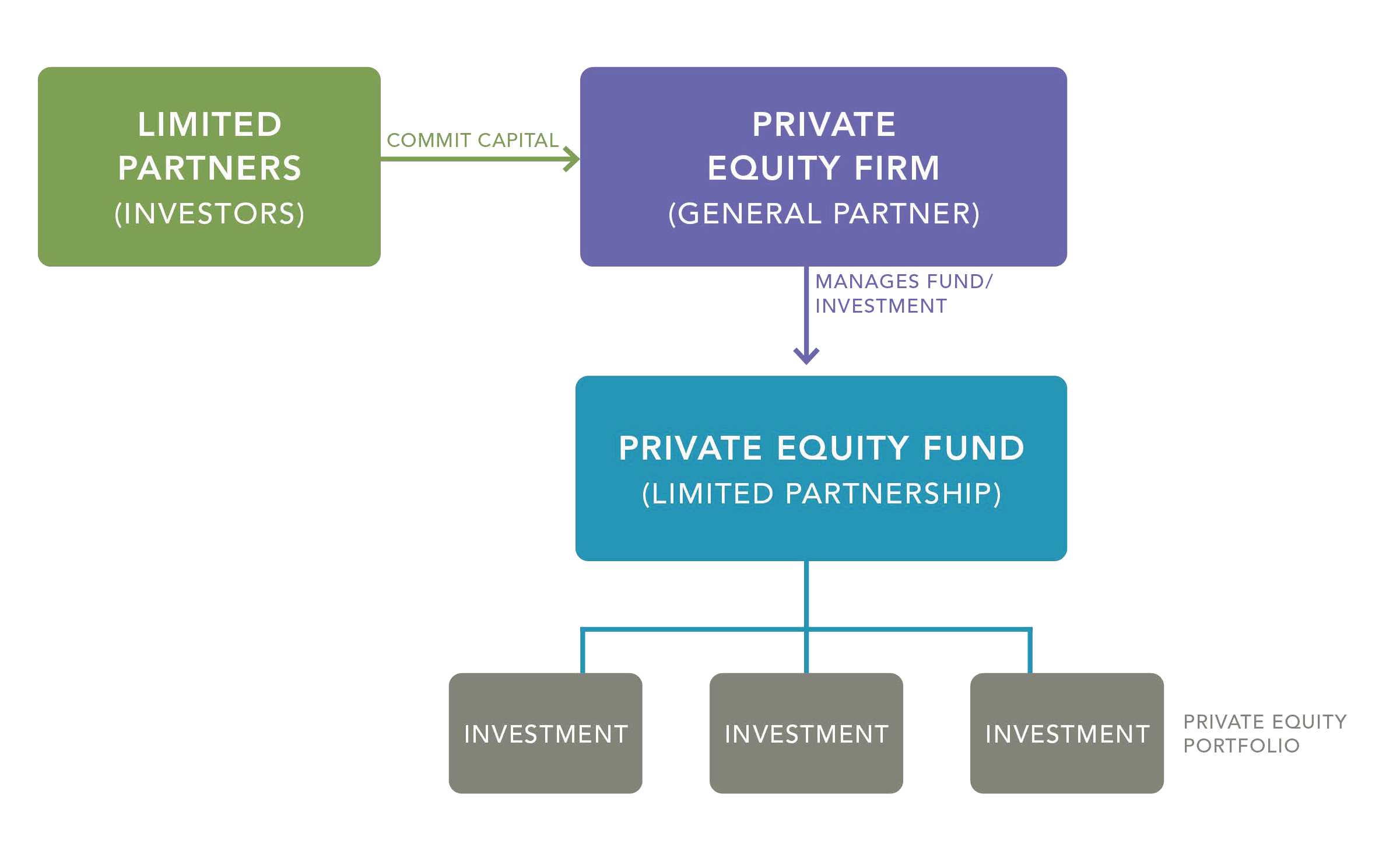

Private equity investors, often at a private equity firm, raise capital from limited partners to form a private equity fund. When they reach their fundraising goal, the investors close the fund and invest the capital into private companies.

The private equity firm is commonly known as the General Partner (GP). GPs obtain investment commitments as well as execute and manage the fund itself.

Limited Partners (LP) are the investors who provide the capital for the fund and may include insurance companies, endowments, foundations, and high net-worth individuals. HighGround Advisors is a Limited Partner.

PE funds usually hold a collection of separate company investments that are made over a prescribed time. This collection makes up the PE fund’s portfolio.

The diagram above illustrates the structure of a generic private equity fund.

TYPES OF PRIVATE EQUITY

GPs seek to identify companies that would make good investment opportunities. They invest capital into companies at all stages of the corporate lifecycle, from early-stage ventures to growth and expansion-minded companies to mature companies undergoing transformation.

The main categories of private equity are:

- Venture Capital – Investors back entrepreneurs’ new business models and product innovations that are sparked by secular and cyclical shifts or technological disruption.

- Growth Equity – Investors fund the growth or expansion of a company seeking market adoption of their product or geographic reach.

- Buyouts – Investors buy out a company with the goal of improving its value and eventually reselling it for a profit. Other opportunities could include the disposal of non-core assets or underperforming businesses as well as the merger with or acquisition of cash flow generating companies that have grown from small market to middle market.

- Other specialized strategies – These may include credit-related lending or turnarounds of distressed businesses.

PRIVATE EQUITY AS AN ASSET CLASS

Historically, private equity investments were grouped within a larger category called Alternative Investments, which included any investible asset category that was an alternative to traditional stock and bond market investments, like real estate, energy, hedge funds, farmland, and infrastructure.

Over time, the capital committed to private equity strategies grew from $500B in 2003 to $3.4T in 2021. That growth and the consistently high performance of private equity relative to other asset categories have resulted in private equity becoming a separate and distinct asset class as well as a staple allocation to all professionally managed investment portfolios.

Private equity is no longer just an alternative; it is a mainstream asset category for portfolio diversification and a source of potential high returns for investors.

PRIVATE EQUITY IN THE WILD: As Limited Partner, HighGround has a direct link to a variety of private equity-backed businesses that make our daily routines more convenient, efficient, and secure. For example, the container holding your home delivery meal or take-out from your favorite deli or fast casual restaurant is likely made by Anchor Packaging, the largest maker of rigid food containers in North America. Anchor is owned by The Jordan Companies, a GP that HighGround has invested with in the past.