Hurdling the Market’s Stress Periods

May 31, 2019 - You’re at the starting line of a 400-meter hurdle race and ahead of you is a long line of hurdles. You have trained and prepared for this event and are confident that you can successfully jump and clear each obstacle to win the race.

Like a 400-meter hurdler, long-term investors will inevitably face “hurdles” from time-to-time in the form of capital market volatility, and hedge funds can play an important role in improving an investor’s chances of clearing these hurdles on the track to investment success.

The underlying investment strategies and role hedge funds play within a portfolio can vary, but most are intended to limit the market’s systematic impact on performance by hedging out a portion of the market’s risk. Unlike publicly traded stocks and bonds, where the main drivers of returns are market movements, a distinguishing feature of hedge funds is that their performance over time is primarily driven by a manager’s ability to generate returns through specific strategies that are largely uncorrelated to the stock and bond markets.

“The primary role that hedge funds play in HighGround’s multi-asset class portfolios is risk reduction with the goal of limiting the stock market’s influence on the overall portfolio’s rate of return” HighGround’s Chief Investment Officer, Joe Wright, said.

Although some hedge funds have the ability to generate equity-like returns, HighGround views hedge funds as a means of investment diversification and a source of differentiated returns. “Hedge funds provide exposure to different sources of return that are not available in traditional asset classes,” Joe said. “And more importantly, they help reduce volatility and protect the overall portfolio in challenging market environments as we experienced in the fourth quarter of 2018.”

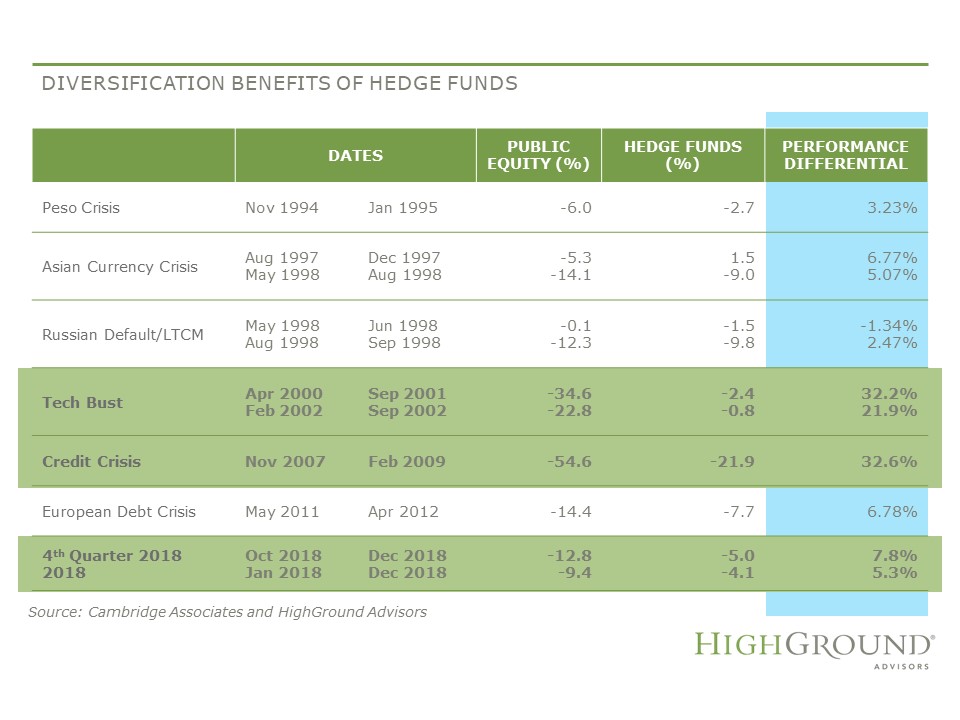

As the table below shows, compared to public equity, hedge funds have historically provided meaningful downside protection during market stress periods over the last 25 years. “And compared to equities, hedge funds were an absolute home run during the tech bust of the early 2000s and during the 2008 financial crisis,” Joe said.

HighGround modified its long-term asset allocation policy for endowments in 2014 to include a 10% strategic allocation to hedge funds. The key reasons for including hedge funds in HighGround’s long-term multi-asset class portfolios are:

- Reducing overall portfolio volatility

- Improving downside protection during market stress periods

- Enhancing long-term risk-adjusted performance

- Investing in specialized strategies with differentiated sources of return not otherwise available in traditional stock and bond strategies

Joe also commented, “since adding hedge funds to HighGround’s long-term strategic allocation for endowment, they have generally performed as we expected, outperforming equity and protecting capital during periods of market turbulence, which we think will improve fund performance over time.”

So much like a 400-meter hurdler prepares and trains for a track meet, we at HighGround believe preparing for market volatility by including diversifying strategies like hedge funds in multi-asset class portfolios puts our clients in a good position to clear the many hurdles along the track and “win” in achieving their long-term investment and financial objectives.

If your nonprofit organization is interested in establishing an endowment, reach out to one of our asset management experts today.