PREDICTABILITY DURING UNCERTAINTY: U.S. TREASURY LADDERS

December 19, 2022 – Have you ever wondered if there is a way to improve the return on your nonprofit’s invested operating reserves with minimum risk and ample flexibility? In this market, some investors may benefit from building a short-term Treasury ladder. A Treasury ladder is an investment strategy used by investors to minimize risk while managing cash flows.

How Do They Work?

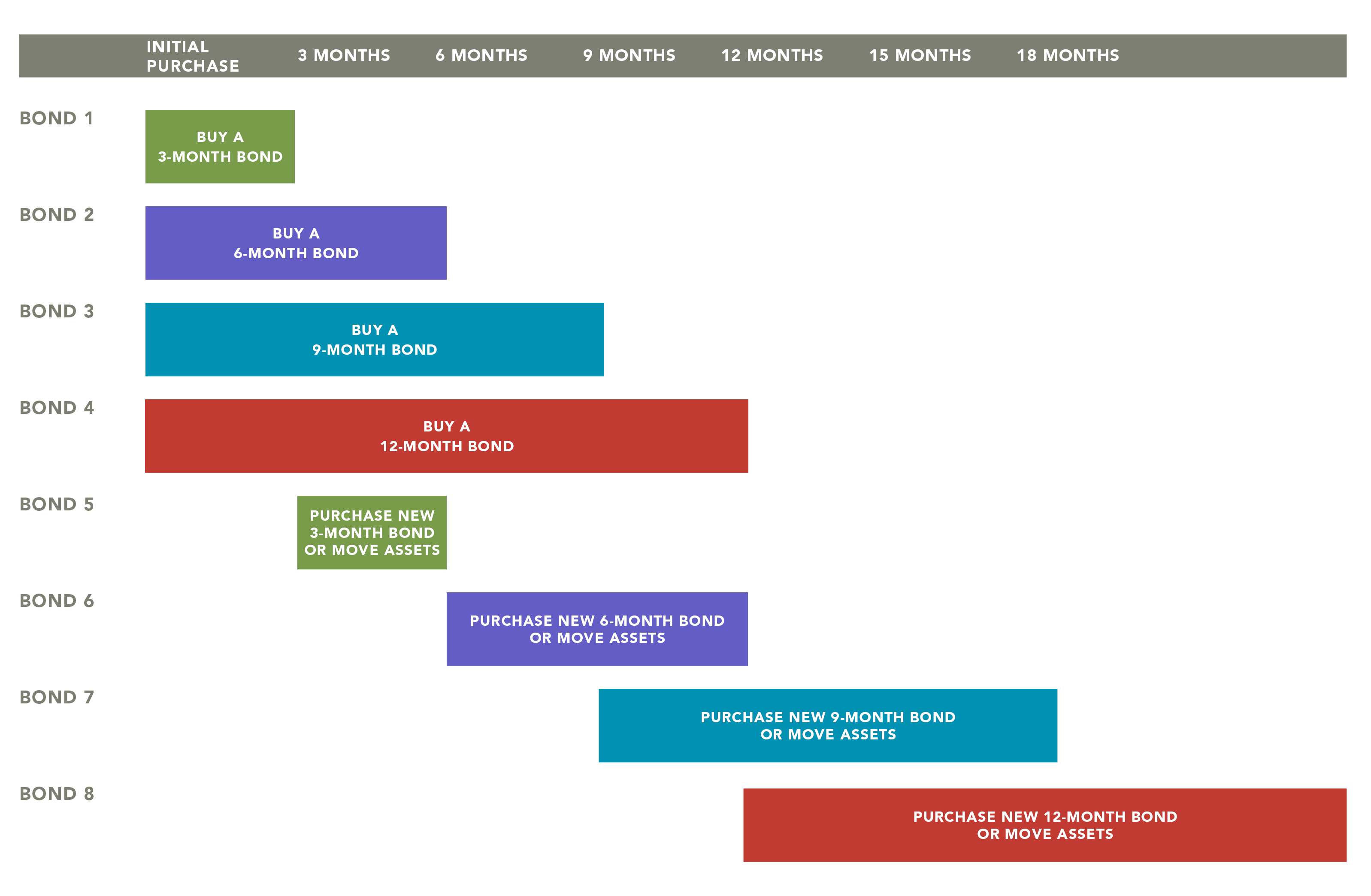

A Treasury ladder is made up of a series of Treasury securities (bonds, notes or bills) with different maturity dates. In markets where interest rates are rising, additional bonds can be purchased at potentially higher yields when one bond matures. If the yield environment shifts, an investor can decide to invest maturing bonds in other more favorable options.

Building a Treasury ladder is quite simple but there are a few things to consider before getting started. First, you must decide the total amount that you plan to invest. Then, based on your cash flow needs, you must decide how far the ladder rungs should be spaced out, which can range from months to years. The spacing is typically equal.

In the example below, our client partner has decided to invest in Treasury bonds that mature in 3-month intervals.

|

Once the first security matures, the client partner has a decision to make. They can either reinvest the principal into a new 3-month Treasury bond or they can spend or reinvest the proceeds using a different investment vehicle.

Benefits of a Treasury Ladder

- PREDICTABLE LOW-RISK STREAM OF CASH FLOW – Treasury securities are backed by the U.S. government, so there is essentially zero risk that you could lose money. This is particularly critical for a nonprofit investing its operating reserves.

- FLEXIBILITY – It’s easy to access your money once bonds mature and to reinvest the proceeds quickly. If, however, funds are needed prior to maturity, you can always sell bonds before the maturity date. It should be noted that there is the risk that the value of the bond at the time of sale is lower than when it was purchased.

- CUSTOMIZATION – Treasury ladders can be built specifically for your unique situation. HighGround can purchase Treasury securities on your behalf at the desired amount and timeframe.

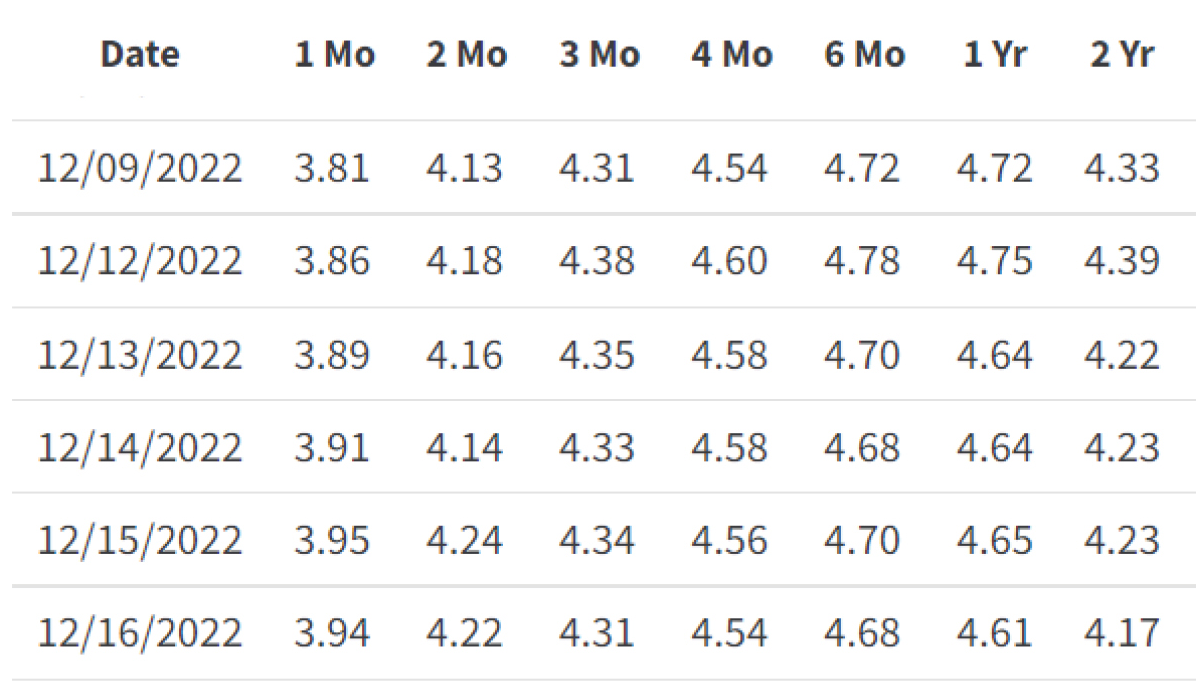

Current U.S Treasury Daily Yield Curve (2 Yr and less):

|

Source: U.S. Department of the Treasury as of December 19, 2022

Window of Opportunity

The Federal Reserve is expected to continue raising interest rates into 2023 and a ladder may be opportune while short-term interest rates are increasing. At the point when the “hawkish” rate increases of the Federal Reserve slow down or shift, it is probable this window of opportunity will close as a favorable option for investing short-term assets.

During times of market uncertainty, it is important to keep your operating reserves growing while remaining safe. To learn more about HighGround's short-term investment solutions or how best to manage your nonprofit's operating reserves, call us today at 214.978.3300.